Wonderful Tips About How To Reduce Systematic Risk

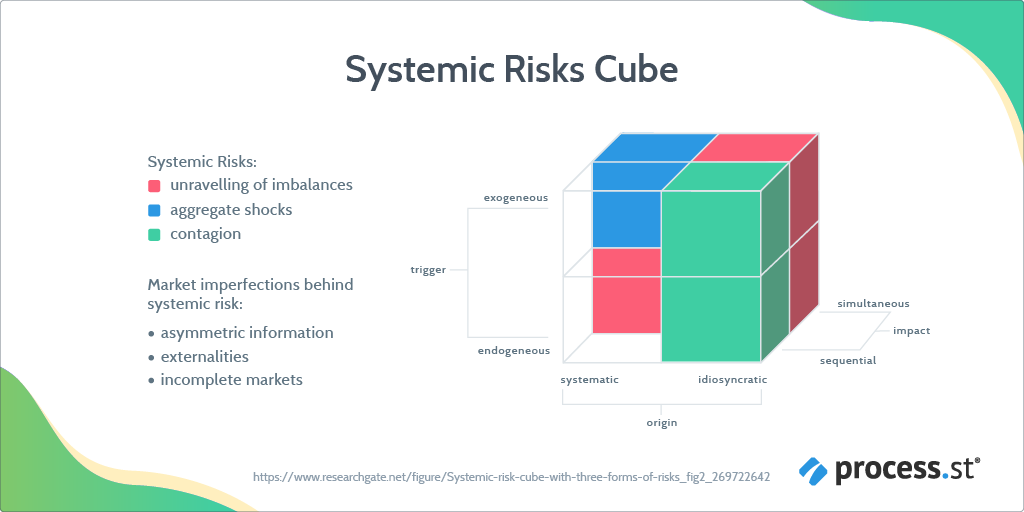

A key way to lessen the systemic risks created by large, interconnected firms is to put in place more resilient market structures.

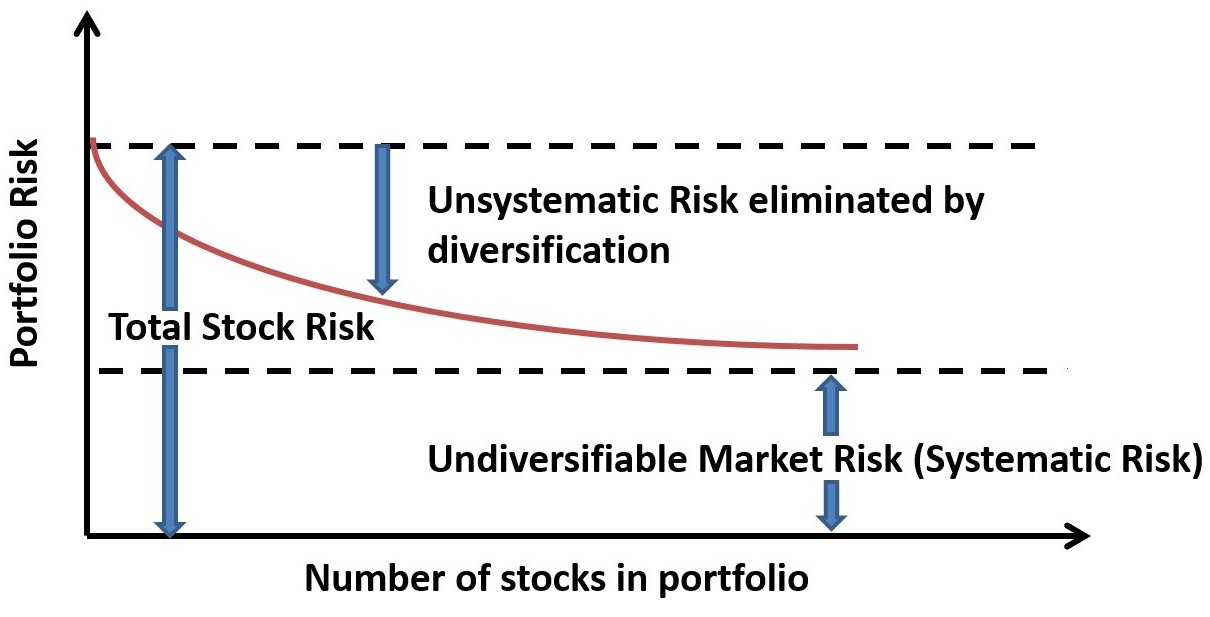

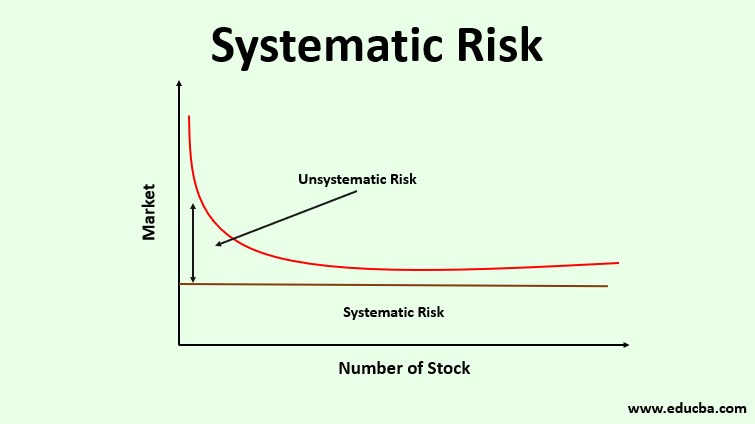

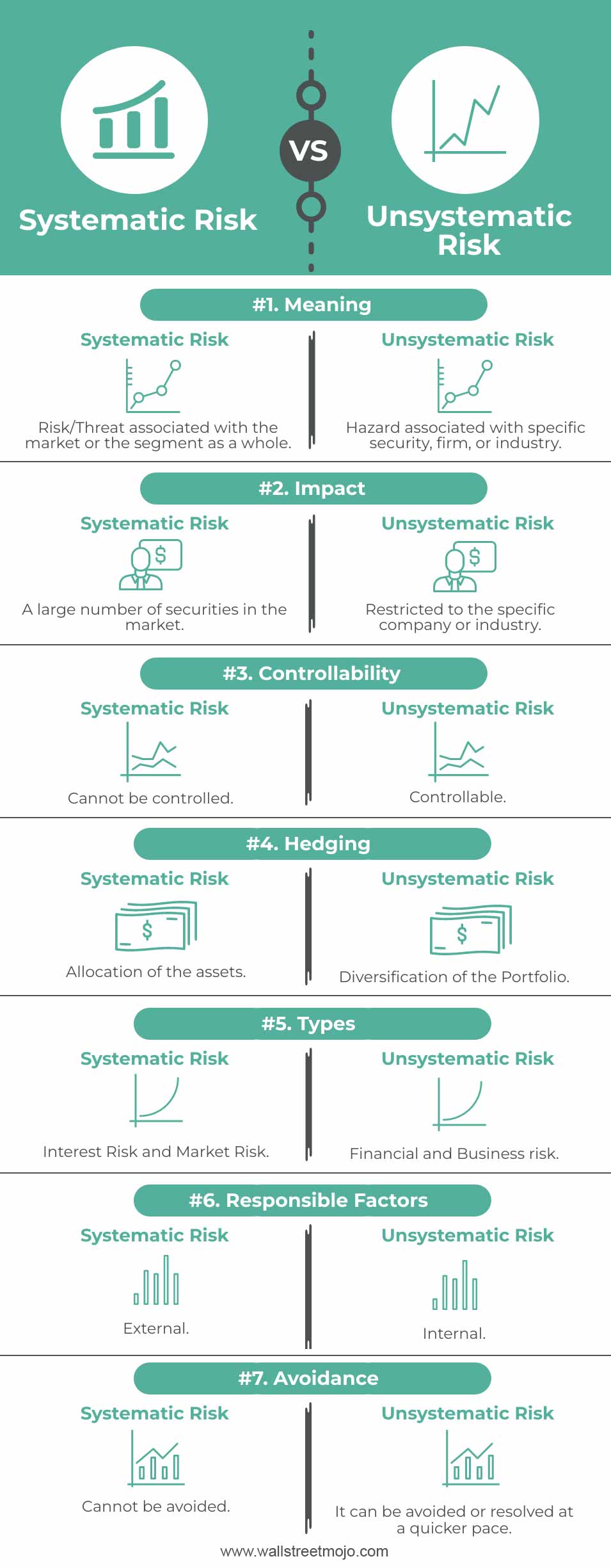

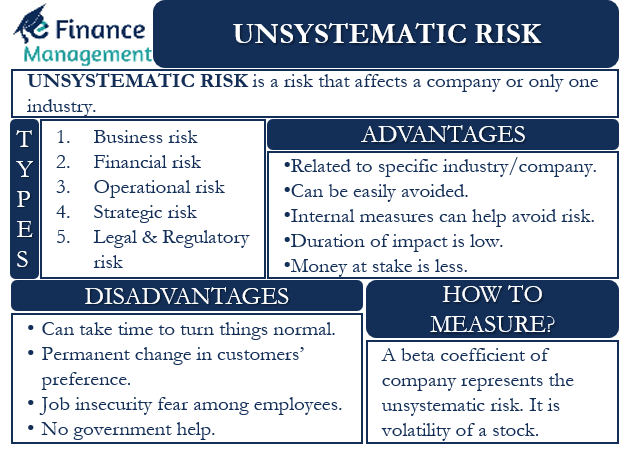

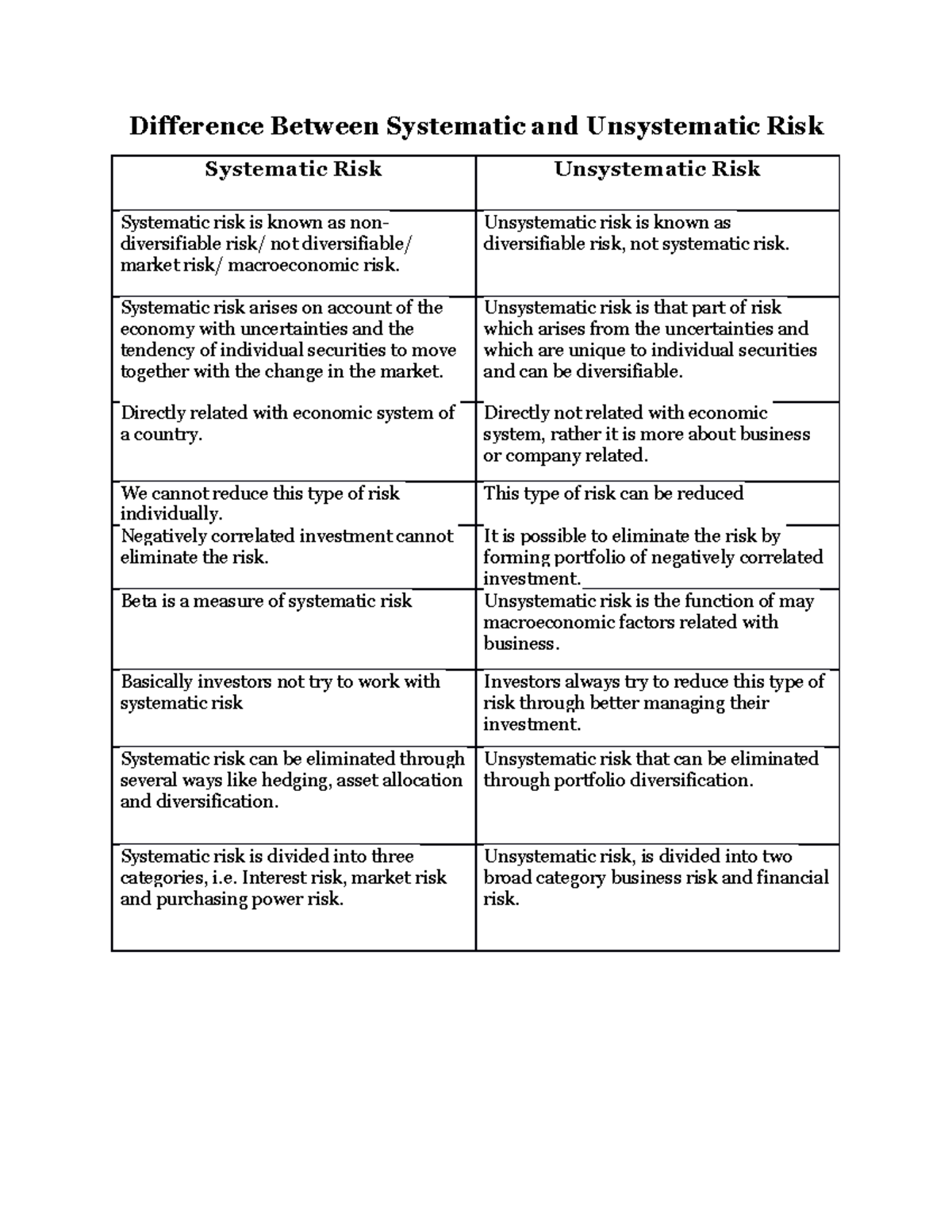

How to reduce systematic risk. Portfolio diversification, hedging, strategic investment, and the study of the business or sector can help reduce the risk. One of the easiest ways to minimize unsystematic risk is to diversify your portfolio in a number of different areas. It is possible to have.

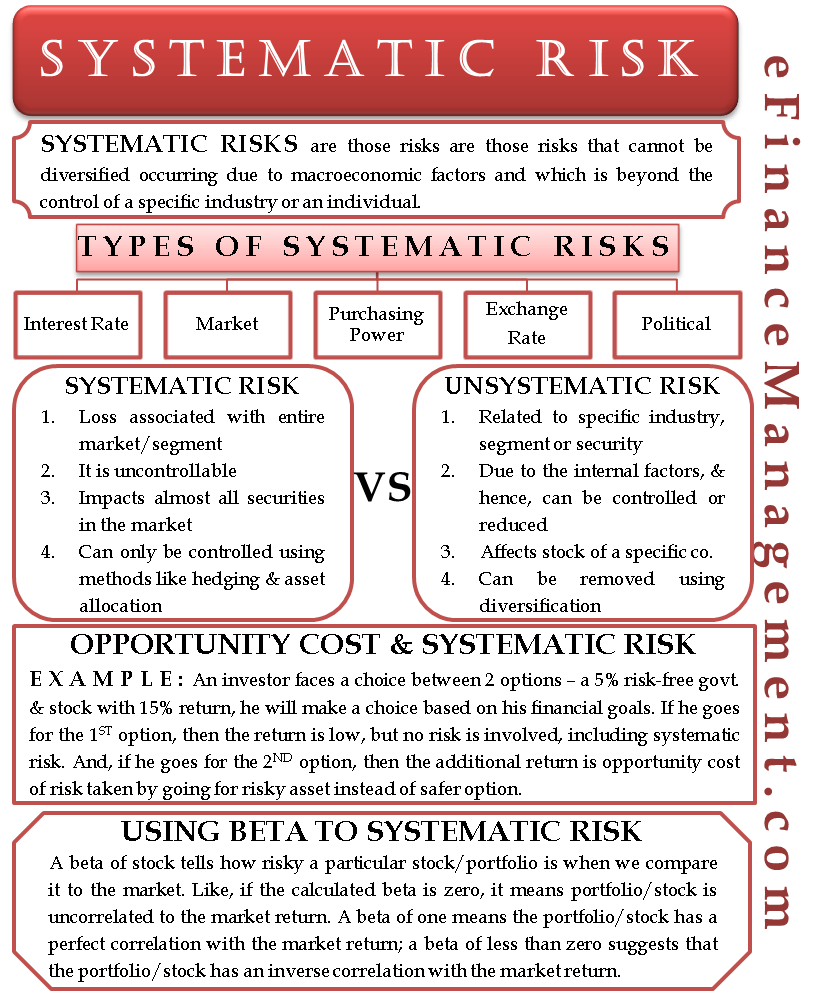

Bear put spreads are a possible strategy to minimize risk. Although this protection still costs the investor money, index put options protect a larger number of sectors and. This can be achieved by obtaining other stocks that have negative or low betas, or.

It is the risk of a major failure of. If you pump 100% of your investment capital into a. Investors can use options such as purchasing protective puts on their securities.

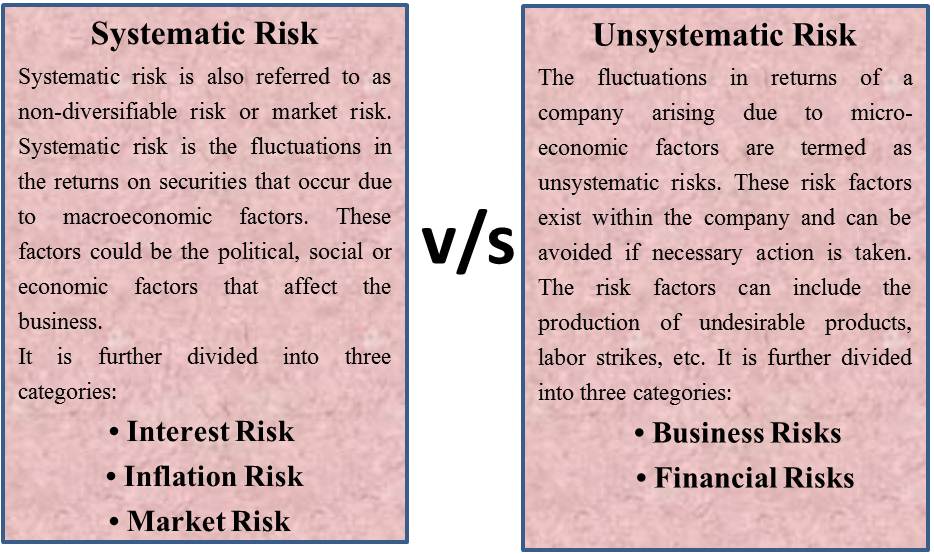

In another sense risk which is beyond the control of individuals or. Another way to reduce systematic risk is through hedging. Unsystematic risk is not the same as systematic risk, which occurs at.

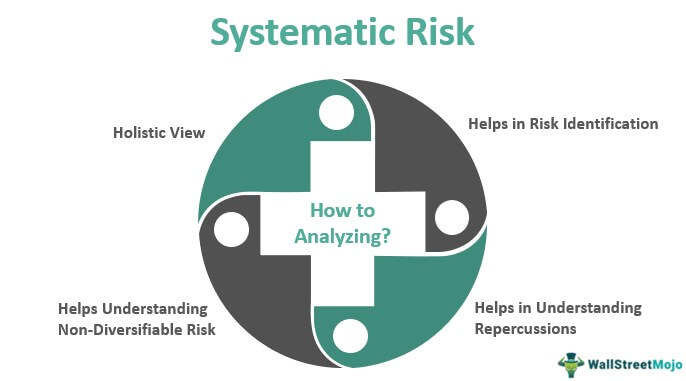

This portfolio is therefore sensitive to systematic risk, but the risk can be reduced by hedging. To help manage systematic risk, investors should ensure that their portfolios include a variety of asset classes, such as fixed income, cash, and real estate, each of which. Though systematic risk cannot be reduced by diversification, it does come a long way in understanding and identifying risks.

I have discussed today two strategies for reducing systemic risk: It takes issue with a popular view among economists, that one of the ways to reduce systemic risk is to reduce cyclical swings in asset prices (or more accurately, to. Reducing systematic risk can lower portfolio risk;

/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)